Painless Taxation

Imagine how your life would be if income tax didn’t exist or was abolished. There would be no more need for tax returns. A big chunk of your hard earned income is taken from you and you have no say in the matter. Tax compliance cost refers to the amount of time and/or money it takes for you to conform to Government regulations so they can fleece you. Then to add insult to injury there is a tax on virtually everything you buy. That is VAT. The crippling price of feel at the pumps is so high because the government add on 60% to the fuel cost for themselves.

Income Tax is a compulsory financial charge imposed on working taxpayers by the government to fund government spending and public expenditure which can mean anything. The amount taken from your income can be quite excessive.

Pay Related Social Insurance, or PRSI, is payable on the gross income after deducting pension contributions. It is only applicable to salaries higher than €5,000 per year.

With that in mind, let’s take a look at how much you need to earn in order to take home €2,000, €4,000 or even €6,000 a month after tax here in Ireland.

For those on €24,000 a year, after tax they would be getting €21,273. This means that their €2,000 before tax is actually €1,773 afterwards.

In order to take home €2,000 a month, according to salaryaftertax.com, a person would need to be on €28,000. After tax, this would amount to €24,133. Monthly, it breaks down to €2,333 before tax and €2,011 after.

An attempt to evade, a failure to pay or resistance to this taxation is severely punishable by law. To manage and police this, an expensive and cumbersome revenue collecting service must be developed. The first known taxation took place in Ancient Egypt around 3000–2800 BC. This income tax system which we are still currently enduring has now gone way past its ‘sell by’ date.

Necessity of Tax

Imagine how your life would be if income tax was abolished. There would be no more need for tax returns. Tax compliance cost refers to the amount of time and/or money it takes to conform to Government regulations so they can fleece you. When it comes to our tax system in Ireland both our compliance costs and collection costs are substantial. However a state cannot sustain itself or run its affairs without an income and taxation is the only viable way of achieving this. Therefore we cannot eliminate tax.

Taxable Transaction

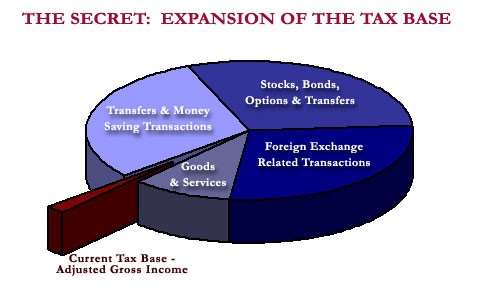

While the elimination of tax is out of the question the elimination of income tax is by no means out of the question. On top of that VAT and many other hidden taxes can be eliminated without any loss to the state. I don’t use the term Exchequer because that would suggest that the money is going to London where they have an Exchequer. The amount of financial transactions taking place between all financial institutions in Ireland runs into hundreds of millions if not billions per year. Add to that all other financial transactions including all purchases and credit card transaction and you surely have billions of transactions. Nobody in Ireland has ever attempted to calculate the financial transaction numbers or if they have they aren’t telling you and me about them. There is a good reason for not revealing those figures because they would reveal a hidden potential for taxing all of those transactions which would result in a huge tax take. In essence this would be a broadening of the tax band to include all of those institutions paying no tax now. Your tax could shrink proportionally.

In the UK there were 963 million contactless card transactions in April 2021. That just came from Covid statistics and that was just one month and with only one form of financial transaction. Those figures would be very different for Ireland with less than 10% of their population but they would be very substantial.

New Tax Sources

Banking and financial services transactions would be both huge in numbers and the amounts of money transacted. That would eclipse the financial amount of all other transactions put together. Those transactions pay little or no tax of any description. What if there was a 1% transaction tax on all those movements of monies? The amount would be a huge increase in tax revenue from a sector that is operating largely without paying any tax. What if there was a 1% transaction tax on all movements of monies by multinational corporations that pay little or no tax now? What would that add up to? Would it not add up to a total replacement for income tax and all other current forms of tax with the added bonus of a much greater take for the state?

Benefits of a Transaction Tax

The benefits of a “Transaction Tax” system to everyone from the PAYE tax payer to the government would be incalculable. Everyone would pay only 1% on all financial transactions. There would be no escaping from such a system. The take would far surpass the outdated cumbersome current tax systems take. If the Irish Government were to replace the income tax with a 1% transaction tax:

- Compliance costs would immediately vanish.

- If every wage earner was given an average increase of 20/30% in their wages tomorrow what would happen to the economy?

- What would happen to purchasing power and turnover if VAT was abolished?

- The individuals spending power would increase dramatically thus improving his/her quality of life and that spending would stimulate the economy beyond recognition.

- Industry and business while paying a 1% Transaction Tax that much of that sector didn’t pay before would benefit enormously from the increased spending in the stimulated economy.

- The government would end up with much more revenue by abolishing income tax and VAT and replacing them with a 1% Transaction Tax.

- The abolition of income tax and VAT would result in a massive benefit to the entire economy.

A Bigger Take from a Bigger Pot

The percentage of those paying income tax is a small slice of the potential tax pie and therefore the tax burden placed on them is disproportionately high. If a 1% tax was placed on all financial transactions without exception the pie would be much bigger and the government intake would be much higher than the take from income tax and all other taxes. because of the relatively small comparative numbers in each case.

Under a transaction tax, every individual, rich or poor, and every company, every bank, every financial institution big or small, would pay the same flat tax of just 1% on all financial transactions.

- This tax would be progressive and equitable because wealthy individuals and corporations conduct the most financial transactions and would therefore pay the most tax.

- It would be fair because no interest group could avoid paying it through loopholes or illegal means.

- With everybody paying just 1% on all of their financial transactions we would all benefit with a lot more money in our pockets together with a massive boost to the economy and a lot more revenue for the government.

- The volume of all financial transactions is estimated to be 100 times larger than the current tax base. Therefore a flat transactional tax rate of 1% on a big pie would raise a lot more than the small pie’s current average tax rate of roughly 30% on beleaguered tax payers.

Balance the Budget

When combined with a Balanced Budget which can now be easily achieved with the increased revenue available to the government and a disciplined cabinet (We will deal with that in the next section next week) that applies intelligence-based decision-making, this tiny 1% transaction tax in lieu of all other taxes removes a great number of economic and other obstacles to doing business and therefore:

- Transform’s the economy,

- boosts the government income

- Stimulates infrastructure improvement and development

- Stimulates productivity

- Stimulates creativity

- Stimulates purchasing power

- Stimulates society beyond all measurable possibilities.

Parasitic Meltdown

A tax on all financial and currency transactions to replace the current income tax system and all the other visible and hidden taxes would be supported by every level of the population with the exception of economist’s, accountants, tax consultants, revenue collectors and all of the parasitic beneficiaries of the current cumbersome tax system. All financial transactions would be taxed at the 1% rate including

- All stock trading and speculation

- currency trading and speculation

- rare minerals speculation

- fund transfers among multinational corporate bank accounts

- offshore banking

- business transactions for tax avoidance purposes

All of the above and all the rest would be subject to a 1% transaction tax on all financial activities without exception.

No More Tax Returns

This one very low universal financial transaction tax rate of 1% could easily, automatically and immediately be collected and transferred electronically to the government coffers. Automatically collected Transaction Tax would completely eliminate a parasitic industry. There would be no more:

- tax returns

- tax collectors

- tax evasion

- tax avoidance

- tax advisors

- tax consultants

- tax accountants

- tax dodgers

- corporate tax lobbyists

Cost Free Revenue Collection

It would remove all the special deductions currently used by the big players. The cost of revenue collection would be immediately eliminated resulting in huge savings for the government. Also eliminated would be:

- the huge cost to taxpayers of paying taxes

- the cost to the government of collecting taxes

- the cost of the huge tax losses due to avoidance and evasion by imaginative accounting and cheating

These amount to huge savings together with a huge and cost free improvement in revenue collection efficiency that should accommodate the ending of:

- personal income tax,

- corporation tax,

- stamp duty

- VAT

- fuel tax

- Green (greed) tax

- alcohol tax

- Tobacco taxes

- sales taxes

- estate duties

- excise taxes

- Capital gains tax

- Gift taxes

Quick and Painless Government Debt Elimination

The resulting stimulus to the economy would quickly eliminate the now crippling national debt. Additional revenue collected could initially be used to:

- Repay and eliminate the national debt

- Recapitalise infrastructure

- Stimulate job-intensive industry

- Invigorate agricultural production

- Stimulate tourism

- Stimulate rural economic development

- Make exports attractively competitive

The Automated Transaction Tax (ATT)

The Automated Transaction Tax (ATT) to give it its full title would be a transformative and revolutionary improvement over the outdated and unnecessarily cumbersome existing tax system with incalculable benefits. It can be phased in over a specifically allocated but short period of time to facilitate a smooth transition from the present system to the 1% Automated Transaction Tax (ATT). It could start with all inter-banking transactions, all financial institution transactions and all multinational corporation financial transactions. Next would be all credit card and ATM transactions followed by all retail transactions. Once the revenue started flowing in daily for a change, the phased elimination of VAT followed by income tax in all its forms would then be eliminated. The results would be immeasurably beneficial.

Family Taxation

A family that previously paid between €5,000 and €15,000 annually in income tax would ends up paying less than €1,000 a year because they would no longer have to pay income tax thus immediately eliminating the €5000 to €15000 tax burden. Instead all of their financial transactions would be electronically taxed at the point of the transaction at the rate of 1% so all of their transactions would be taxed which would cost them in the region of a €1000 per year.

No More Tax Ducking and Diving

Most of those who now escape taxation, particularly in the area of corporate financial transactions including stock purchases and currency trades would be paying 1% that would more than make up for the €5000 to €15000 shortfall in take from the family now paying just a €1000 pa.

The great advantage of the Automated Payment Transaction (APT) Tax system for all concerned is the one very low 1% universal tax rate that can be automatically and immediately collected on all transactions and immediately transferred into the government’s coffers with very little cost compared to the present cumbersome system.

Since the financial volume of all transactions is estimated to be more than 100 times larger than the current tax base, a 1% transaction tax would collect much more revenue than the current system could ever hope to. It completely eliminates tax returns, corporate tax lobbyists, and all special deductions.

The Benefits of Simplicity

Rather than taxing personal or corporate income we simply tax all electronic movement of money.

- The current income Tax system is hugely, inequitable, unpopular and easily corrupted. It must be eliminated entirely to make way for a far better and fairer system that would raise much more revenue without penalising work and workers as does the present system.

- Money is no longer just a means of exchange. It is also a tradable commodity which is bought and sold on world markets. Therefore it can and should be regulated and all its transactions should be taxed.

- Most if not all major money transactions are electronic. A very small percentage involves cash.

- Every time an electronic transfer of funds takes place, the Automated Payment Transaction (APT) Tax system would simply take 1% off the top. A small software tweak would make this possible.

- The software for the system is already in place to record transactions, take and make payments, collect and remit funds and charge for the service. Banks and credit card companies have been doing this for years.

No Room For loopholes

Transfers by the government like all other transfers would be subject to the 1% tax. There would be only two exceptions.

- The transfer of collected tax funds to the government.

- The account holder may deposit and withdraw CASH from his own account at his own bank without an electronic taxable transaction taking place.

FAQ’s and Concerns

No mortgage interest or charitable deductions would be ‘transaction exempt’ and no exemption would be made for interest on government or municipal bonds.

Health insurance transactions provided as benefits to employees would be taxed just like any other compensation. It would assume the same 1% tax rate for capital gains and any other income.

That would automatically put an end to all the present games of tax avoidance and evasion that are played out annually including “carried interest” tactic used by private equity firms and the rich and famous. Drug dealers and other criminals will continue to accumulate large sums of cash and try to launder it in many ways that cost a lot more than 1%. Those criminals would be more than happy to pay just 1% rather than pay the cost of laundering money. Of course there may be other considerations and consequences for them.

On the corporate side all financial transactions would be subject to tax including overseas income. Tax credits would be allowed where foreign taxes have already been paid. All tax reducing incentives to invest in low-income housing or in wind energy projects or a myriad other things would be eliminated. With the cost of tax on raw materials and production eliminate and the increase in wealth from tax free incomes and earnings most people would be able to buy houses.

A Bit of Reality

Mortgage interest deduction would clearly be seen as a vote to raise taxes on those who don’t receive that deduction. The same goes for the capital gains preference, charitable deductions and charitable status.

Governments presently legislate for tax benefits as if they imposed no cost to others. This would make it clear that is not the case.

Presently General Electric and Apple find ways to avoid paying taxes and as a result others including small businesses end up paying more. That’s an example of the inequality of the present system.

The rest of us presently carry the tax burden of those who pay little or no tax. We have justifiable reason to resent those tax breaks and the present inequitable system. Most tax breaks would not pass through legislation if the cost to the rest of us was transparently clear. Full transparency or exposure of the present inequitable system would lead to a tax revolt not seen since the Boston Tea Party.

Replacing Income Tax

Cash, barter and IOU’s would not be included as they would be impossible to track. A very small percentage of cash transactions take place now and usually for small amounts. But the inconvenience factor, coupled with the security risks of carrying large sums of cash will prove too cumbersome for most people. A 1% tax is a small price to pay for the security value alone.

The No Tax Area

Yes, cash is anonymous, as it should be. Cash would not be taxed. The cashing of a check, at the bank of origin, making cash deposits into your own account at your own bank or cash withdrawals from your own account at your own bank would not be taxed.

Some people will try to avoid the tax by operating on a cash basis. Let them. Circulating cash is eventually deposited into the electronic system and taxed accordingly anyway. A limit could be established to tax cash deposits over a specified amount, say €10,000.

Tax Them

We already have laws requiring the reporting of large cash deposits in banks. Now we will tax them. The 1% tax is so low and the amount of cash circulating in the system is so low that trying to collect taxes on the cash would cost more than the taxes collected.

The new transactional tax regime would eliminate illegal financial activities and the black economy would disappear. Think about all of those people who work ‘under the table,’ these who take off the books cash-only jobs. They pay no tax on that undocumented money. Also, if you are not paying towards Social Security you are not contributing to your future care.

Those who peddle drugs or engage in other illegal activities, such as working under the table, would be less likely to do so if income tax was abolished. People would no longer have to pay a big chunk of their earnings to the Government or turn to inappropriate and illegal methods to adequately provide for their families.

The New Tax Collector

The only question is whether the sender or the receiver pays the 1%. IE: If you agree to pay john €100.00. do you need to pay €101.00 to cover the 1% tax so John gets €100.00 or do you pay €100.00 and John ends up with €99.00? I would suggest that only the receiving entity would collect and remit the tax to the government. The tax collected would electronically forwarded daily to the treasury along with a report of the total day’s transactions and receipts signed off by the CFO. Lying on this form would be a felony offense with a mandatory 10 year jail sentence, so cheating would become very rare as well as very difficult.

No More Tax Deductions

ALL deductions, credits, special provisions and income from the tax code would be eliminated and replaced by a simple to implement and hard to scam system that taxes all money movements. Charity and church donations will no longer have any special tax exemption status.

Some piecemeal attempts to implement a transaction tax were attempted on a limited basis in the past on securities transactions. They were counterproductive because they were additional rather than replacement taxes and a transaction tax cannot work effectively as an additional tax or on a limited basis. It has to be an all embracing replacement tax to make it robust, fair, equitable and effective and be implemented universally on all financial transactions to replace all other taxes.

Impact on the Treasury

This electronic collection system would provide daily cash flow to the treasury providing it with liquidity and enabling it to make extremely accurate forecasts. It would free up the government to concentrate on how to invest the money rather than on who to protect from the tax code. Tax expenditure which was previously hidden would be recorded as direct government investments or as expenses on the balance sheet. All government financial transactions would show up as transaction so they could no longer be hidden. The huge boost in government income should enable it to plough 50% or more of it back into national infrastructure and economic development incentives. That should be compulsory.

Electronic Transactions

The electronic system is already in place and well established for bank and credit card fees so extending it to a 1% tax would be easy. There would be no record keeping requirements for individual taxpayer transactions so nobody would know how much money you have or how much you spent. Financial institutions would have the 1% transaction taxed at source so all they would have to do would be a reconciliation accounting procedure for their own records. They already run their daily receipts every day so this is elementary for them. Channelling funds through intermediate banks will probably decline as a result of this system.

Foreign Financial Institutions

I don’t think we can require foreign banks to collect taxes for us, so a foreign bank on foreign soil would be able to receive overseas funds without paying taxes to the Irish Government but any funds that they transmit to or from the Irish system will automatically be subject to the 1% tax just like any other transaction.

Note: When foreign governments discover how easy it is to collect their taxes using this system they will soon adopt it too.

Social Security and Disability payment

In order to preserve the simplicity and integrity of the system, any and all payments made by the government will also be subject to the 1% tax. To avoid this, in the case of Social Security and pensions is for the government to grant those recipients debit cards to access the funds held in their accounts until used in a transaction. It would be like a secured credit card with a monthly limit which would also be much more cost effective than the present payment system.

How will this 1% tax affect me?

You will continue doing all the things you have always done except for one. You will never again have to file an income tax return or pay income tax. Since all taxes are paid up front on each transaction you will never owe any money to the government.

- Investments would be taxed

- Pay cheques would be taxed

- Purchases by plastic would be taxed

- Mortgage payments would be taxed

- Transfers of capital within a company, from one bank account to another would be taxed.

- PayPal would be taxed

- Foreign aid would be taxed

The list goes on and on without exception. All recordable electronic transactions will be taxed. The government won’t care how rich someone becomes because we know they have paid the tax on their income and will pay again when they spend it.

With the 1% being so low people won’t even notice that there is a tax. With steady income and constant reporting, the government will have extremely accurate projected income figures to work with. Foreign transactions by Irish entities could and should be taxed in the same way. There will be no more hiding ones money offshore. Any financial institution transferring funds to or from the Irish system will be required to participate in the tax collection system. There will be no exceptions.

Abolish Revenue Collectors

Of course by abolishing income tax and VAT you abolish the Inland Revenue. The elimination of income and all other taxes would result in the eradication of the Inland Revenue Service. Without an income tax there would be no need for such a large and costly money wasting entity.

Since Revenue employees and the myriad of other parasites that presently live off the tax system would now be redundant they could move to a less fortunate country and seek employment with an antiquated system such as the one they have just left. No gainfully employed people would mourn their passing.

Everyone Would Have More Money

How would this 1% transaction tax benefit society? People who have more money will spend more. More spending power means greater economic development. This would generate and stimulate growth in a stagnant economy and would also allow people to invest in their future. More money in their pockets would enable them to pay for their cost of living and set money aside for a home, their child’s education, for leisure activities, for their retirement and their family.

Family Benefit

Families would have about 30% more income per year. Without VAT and duties on fuel and other commodities purchasing power would be greatly increased and as a result those currently struggling would receive a much needed boost to handle their everyday expenses with greater ease. Single parent households wouldn’t have to struggle to find the balance between work and caring for their families. They would be able to use their hard earned money to not only pay their living expenses but to adequately afford day-care for their children which would now be lower because of providers eliminated tax overheads so that they can work without having to worry about being penalised.

Economic Stimulus

With income tax replaced with a 1% transaction tax the economy would be stimulated at least ten-fold. People would work just as hard as before to earn the same money but without a big tax chunk being taken out of it so they would be able to truly reap its benefits. They could save more as well as spend more which would do wonders for the economy. The economic surge this would bring about would enable the country to quickly reduce and eliminate the massive national debt. And No. That wouldn’t cause inflation. Inflation is caused by printing excessive amounts of paper money with nothing tangible to back it.

Government Spending

Corrupt politicians would have fewer opportunities to fiddle expenses and there would be no hiding places for their money. A 1% transaction tax regime would likely make the Government more thoughtful in their spending of tax revenue. You wouldn’t have to worry about how the Government was spending your money because of the transparency of the new system. However governments have a track record of being irresponsible to the extreme and corrupt to a fault. Unless there is a powerful, independent system of checks and balances put in place the government would quickly throw a spanner in the works of this new tax regime with excessive spending, salary increases and perks for themselves of an unsustainable level. More on that in our next episode entitled a ‘National Oversight Commission’ Part 6.

Income Tax Disproportionality

The present tax system serves to generate inequality and discourages the creation of equality. From a global economic perspective Ireland it is highly disproportionate in wealth distribution and the middle class continues to be penalised to extinction. While some of the wealthy certainly pay a higher portion of income tax many more are able to take advantage of tax avoidance schemes on a grand scale. Take for instance the CEO of Dell. As one of the wealthiest individuals in the world he earned approximately 40 million dollars in 2005. He paid about 2.5 million dollars in income tax that same year. For someone who is that wealthy, that is merely a drop in the ocean!

Cost Effectiveness

With income tax abolished and all associated administration costs replaced with a virtually cost free transaction tax, compliance costs would be eliminated across the board and a whole lot of time and money would be saved. Rather than spending millions trying to comply with Inland Revenue’s requirements people would have more time and more money to invest in other areas of our economy. Additional incalculable benefits would accrue such as the suppressed creativity of the people which would now be released.

Year after year it takes more time and more money to ensure full tax compliance in an antiquated system no longer fit for purpose. Wouldn’t it be so much simpler and better for all concerned to replace it with a 1% transaction tax that would save both time and money for everyone involved as well acting as the greatest all-round economic stimulus package of all time?

Transaction Tax Would Lead to Greater Visibility

Let’s consider for a moment your personal income tax. Over the course of a year you work hard to make a certain amount of money. A considerable amount of your time and effort working is taken up to pay income tax. Many of us probably don’t keep track of how much we are being taxed until tax season rolls around. For many of us it’s automatic. It is not something we typically think about until it comes time to either secure a rebate or pay out more to the Government. With a Transaction tax every item would be taxed. The tax charged would be printed right on your receipt at the time of purchase.

Rather than spending countless hours with an accountant trying to figure out how much money you paid out or owe to the Government, a transaction tax would provide greater visibility with regards to both taxation and spending.

Transaction Tax Would Help Savings

If the Irish government were to implement a transaction tax we would have more money to save for a start. People would not only have more to spend but they would have more to save as well.

The national savings rate is defined as the amount of money that is not spent. It is calculated by measuring the difference between personal income and personal consumption.

With the people being taxed on their income they are left with little or no extra money to spend and they certainly won’t have much leftover to save. Nowadays people are trying their hardest just to provide for their families, let alone having additional money to set aside for savings. Transaction tax would leave people more take home money and more money to invest in savings.

Income Tax Reduces Work Value

Income tax makes working feel futile. “I’m just working to pay the tax man” is a common refrain. An important consideration is the adverse effect income tax has on a person’s work ethic and the value, the quantity and the quality of the work they perform.

With a Transaction tax, John’s wages would remain unaffected. He would still be working for the same amount per hour but he would now be taking home every Euro he rightfully earned. Even with a 1% tax on his spending he is still winning. He can decide what, and if, he makes a purchase and how he spends his money.

Conclusion

The Irish tax system is an outdated hangover from the British Imperial system. The government relies on taxpayers to support the entire government system as well as all the states costs and expenditure through their taxable wages.

Over the years our current tax system has fallen prey to much abuse. The current system is inefficient, is no longer fit for purpose and is in need of major revision. Those who claim that it would be difficult to eliminate income tax and replace it with a 1% Transaction Tax that would generate a lot more money without wreaking havoc on our society have neither the national nor the individuals interest in mind. The present system is wreaking havoc on the economy and on society.

Abolish Income Tax

Regardless of the arguments it is becoming more apparent that it is time to make a change to the tax system. Replacing income tax with a 1% transaction tax is the change the Irish tax system needs to survive and flourish. With a computer programme able to do all the work of the present revenue collecting system with less than a fraction of the cost there is no excuse for retaining the present inefficient outdated system. By abolishing income tax, the government would allow workers to keep their hard earned income. It would also generate a greater level of fairness between social classes. A transaction tax is infinitely better than what we have now. It is a more viable, more equitable, more effective and a more favourable option for the Irish people than the crumbling old income tax system inherited from the British.

Designing the Future

It’s high time we created our own non penal tax system for Irish people in a viable healthy New Ireland. There is no point in complaining about the present antiquated system. We must create a new system and now we have the blueprint to make it our future reality. That can only happen with your committed support. Do you want to go on paying tax for the rich who pay no tax? Are you prepared to organise and do something about taxation to create a better Ireland for yourself your children and for our future generations?