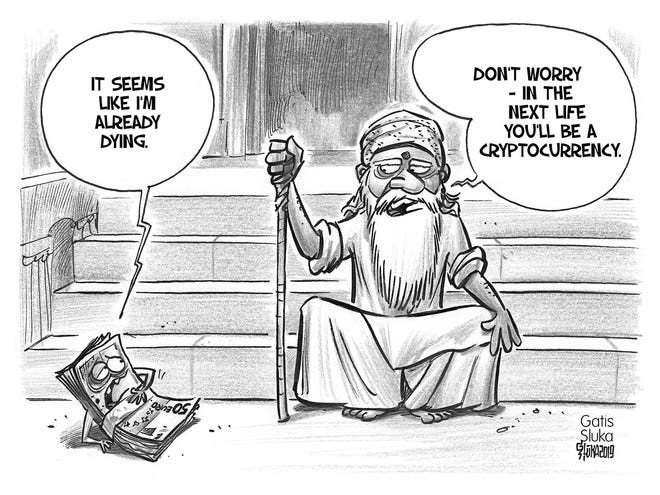

Retailers such as shops and restaurants could be required by law to accept cash payments to support new banking rules. Banks will be required to provide customers with “reasonable access to cash” in a draft bill to be tabled by the Department of Finance early next year. The requirements may include a minimum number of cashpoints per town or region and will also include independent ATM operators supervised by the Central Bank.

The move follows the Department’s overdue review of retail banking which was accepted by the Cabinet yesterday. It follows a public outcry which recently forced the majority state-owned AIB to row back on its decision to eliminate its cash-handling and ATM facilities from 70 branches. “People like, or indeed, need to use cash, and uncontrolled changes resulting from individual commercial decisions are leaving them behind,” Finance Minister Paschal Donohoe said. “This isn’t fair and it could be damaging to financial inclusion.” Lenders (banks) are being asked or is it, told to continue providing access to cash deposit and withdrawal facilities at December 2022 levels until the new “access to cash” bill becomes law.

Bank Branch and ATM Number Requirements

The new law may require a minimum number of ATMs per town or region, Mr Donohoe said. “The Government might decide it is appropriate that, inside particular areas – that citizens or communities above a certain level – should have access, in a point, to the ability to deposit cash and the ability to withdraw cash. We will have to consider whether that is appropriate here in Ireland for that to happen, given our population densities, and given the fact that we now have a more concentrated banking sector than we had a year ago.” The weakness of the review is that it doesn’t specify a minimum number of bank branches. “I believe that would be an exceptional intervention into commercial decisions that banks make,” Donohoe said.

Woke Retailers

Officials are considering the extension of cash rules to include newsagents or cafes, under a proposed new payments strategy due in 2024. There are concerns that if more shops and cafes go cashless, it could compromise the proposed rules for banks. What about customer rights? What ever happened to centuries of doing business using cash with no difficulties? Has the entire business sector lost its sense of service to customers? Cash has been king for centuries and it will continue to be king for the foreseeable future with a little help from customers who refuse to be dictated to by woke retailers. After all the customer is and has always been king in any purchase interaction. Have retailers forgotten this?

Resented Regulation

Nobody likes government interference but there comes a time when some kick ass is required to return the banks and some woke retailers to a sense of service and reality. The head of the ‘Restaurants Association of Ireland’, Adrian Cummins said ‘the Government should stay out of individual firms’ business decisions. “We would be seriously advocating against that,” he said. “It needs to be evidence-based and they would have to do an impact assessment [to see] what are the accidental consequences. Certain coffee shops I’ve seen, that’s their marketing ploy: card only. That’s their own business decision themselves. We’re not advocating that society should move 100pc at all to card. Cash is still part and parcel of it.” We should not do business with those little woke dictators who have completely abandoned their sense of service and reality.

Customer Led

The managing director of ‘Retail Excellence’ Duncan Graham said any moves need to be “customer-led, rather than retailer-led and government-led. There is still, in very many sectors, a big dependence on cash,” he said. Someone should ask him what are some of his associations problem with cash?

Social Obligation

The head of the ‘Convenience Stores and Newsagents Association’ Vincent Jennings, said it was a “social obligation” to accept cash that might “possibly” require legislation. Hasn’t cash always worked fine as a means of doing business without the need for legislation. That was before some ‘woke’ retailers and banks tried to impose the replacement of cash for their convenience. The bullshit concept of a “cashless society” then came along and attempts have been made to impose it on society. The review suggests the Government “consider and consult on whether to legislate pre-emptively to give the Minister for Finance the power to require certain classes of firms, sectors or sub-sectors to accept or facilitate (to an appropriate level) the acceptance of cash”. Public bodies should be required to do so, it said. Only in a world gone mad where the lunatics are running the asylum are the proposed regulations necessary.